Title Insurance

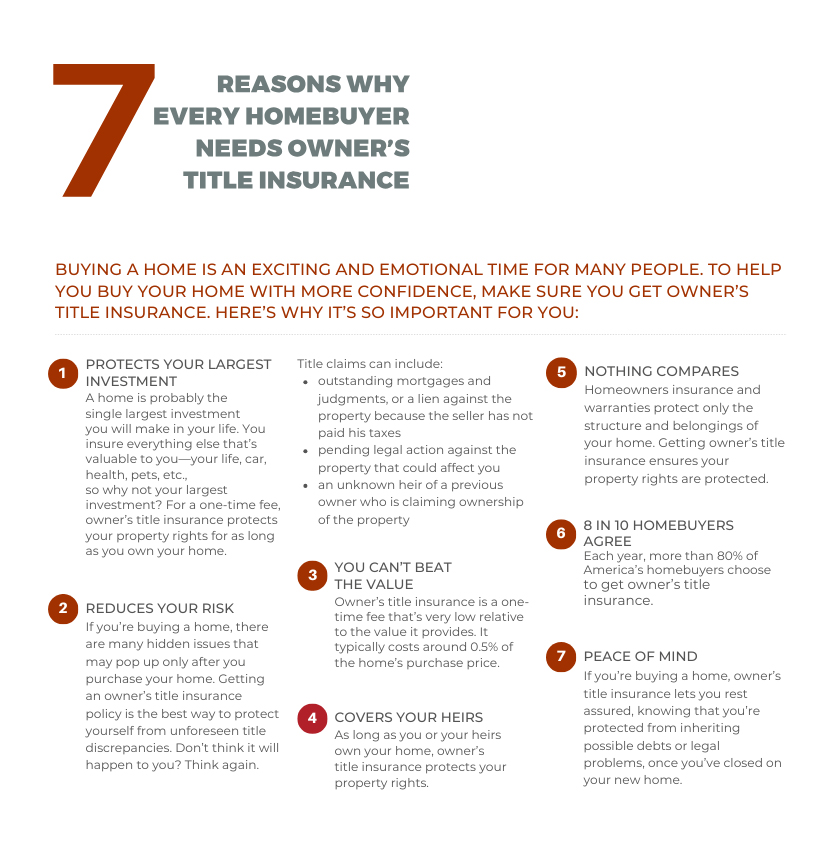

For most Americans, our home is the single largest financial investment we ever make. More importantly, it’s where we raise our families, share time with friends, live our lives. And while ownership of our home may seem very straightforward, our rights to enjoy our property aren’t always as clear. There are literally dozens of ways in which your title to – and the ownership of – the property can be jeopardized. Land Title and the policies it provides exist to ensure that title issues don’t affect your home ownership.

The title insurance policy is what people usually think of when they think of title insurance. For this reason, there are two kinds of title insurance policies: one for the owners and one for the lenders. An Owner’s Policy provides you with assurance that if a title problem arises after you buy your home the policy will stand behind you – monetarily and with legal defense. Bottom line: Your Owner’s Policy will be there to help pay valid claims and cover the costs of defending an attack on your title. Receiving an Owner’s Policy isn’t always an automatic part of the closing process, however. Be sure to request one. Because with an Owner’s Policy, you could be liable for these costs and legal fees, even if you prevail in a legal action.